Inter-market Watch |

Intermarket analysis between gold and bonds generate the greatest signal of a change in trend. Several years of US monetary easing has devastated the global economy with oversized debt burdens in most Western and some Asian Nations. This has led to a growing demand for the gold-exchange standard as the oil market plunge signals deeper troubles for debt riddled economies. Consequently, intermarket analysis of the major markets during 2015 reflect an upcoming change in trend. It is important to realize that fluctuating market conditions require applying a variety of intermarket analysis.

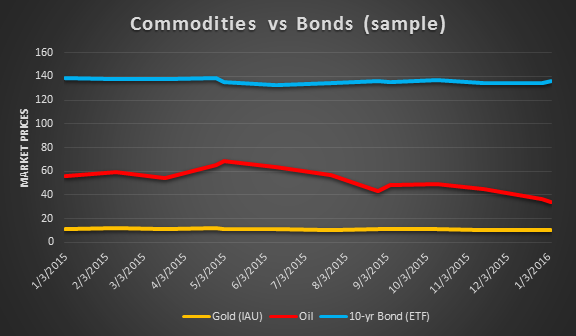

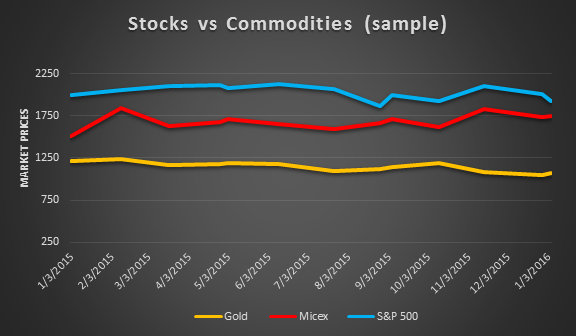

Commodities, Stocks and US Bonds

It is obvious that Gold and US Bonds sideways trend forced the plunge in oil prices. Exclusive reports reveal that ISIS and the Chinese Triad are building a terror ring from the US Asian military pivot. This explains why the US bond market is so trendy from “monetary easing policies”.

The S & P 500 has reached record highs during the years of US monetary easing compared to the Micex which is supported by the gold exchange standard.