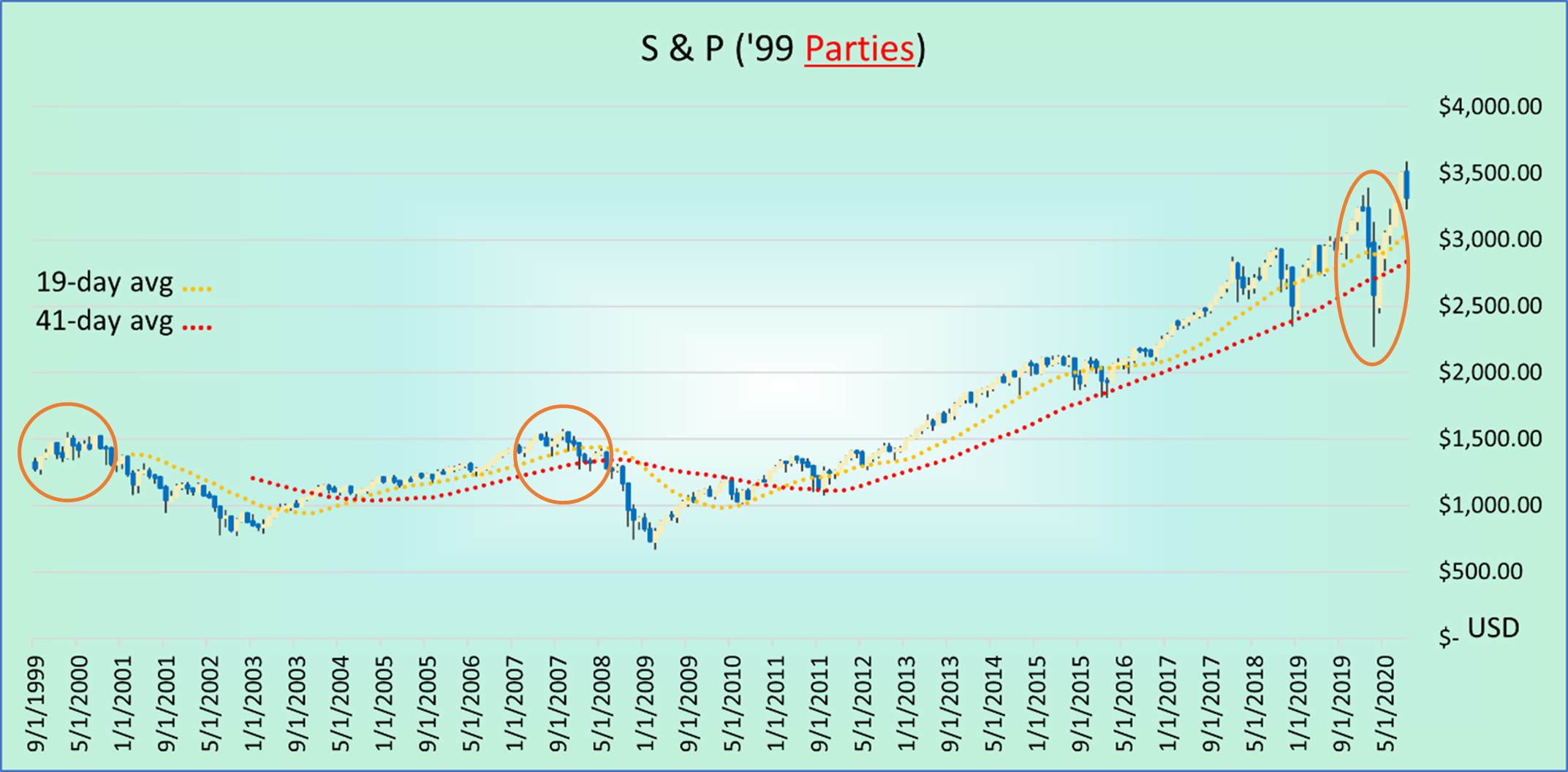

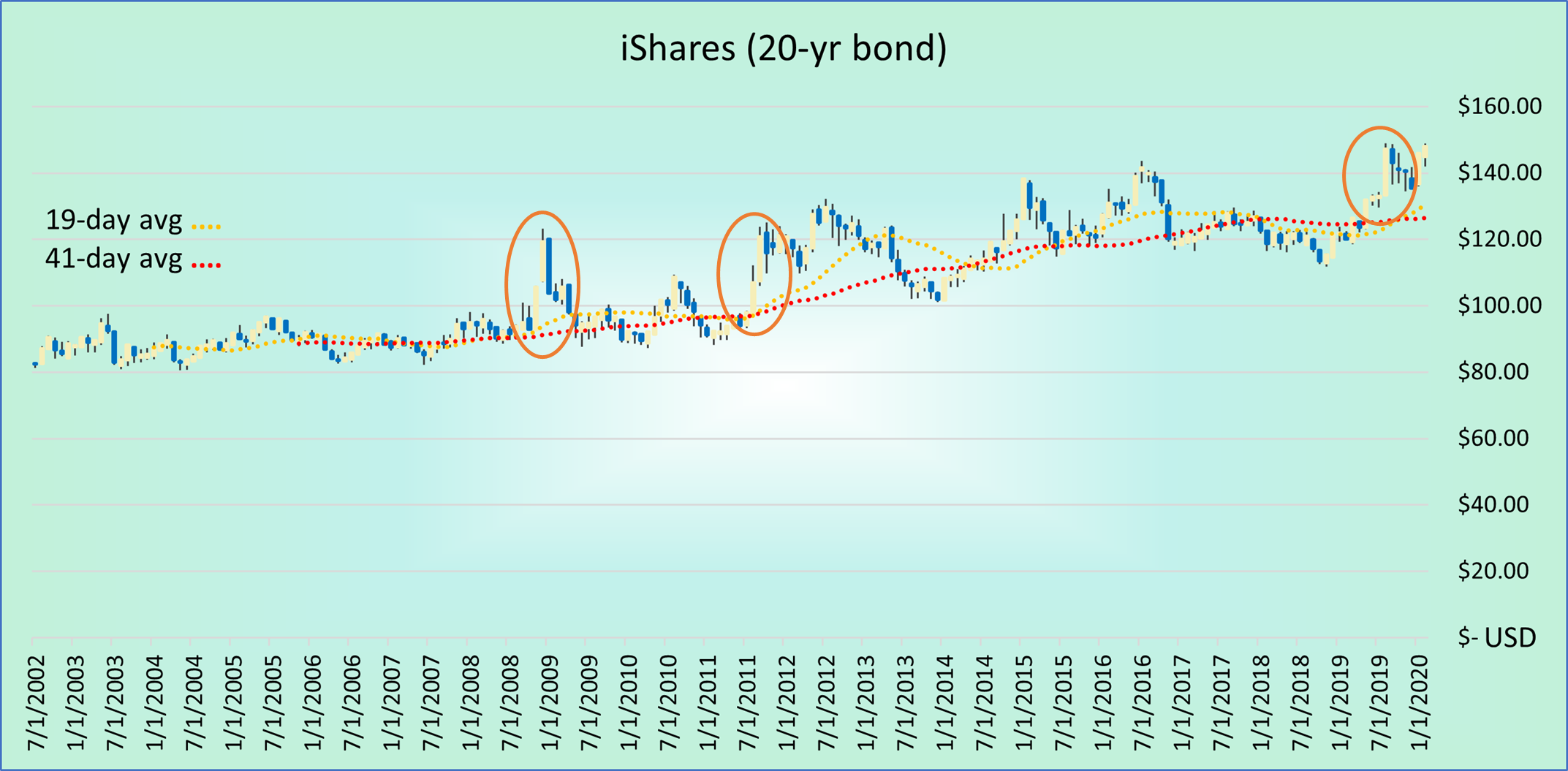

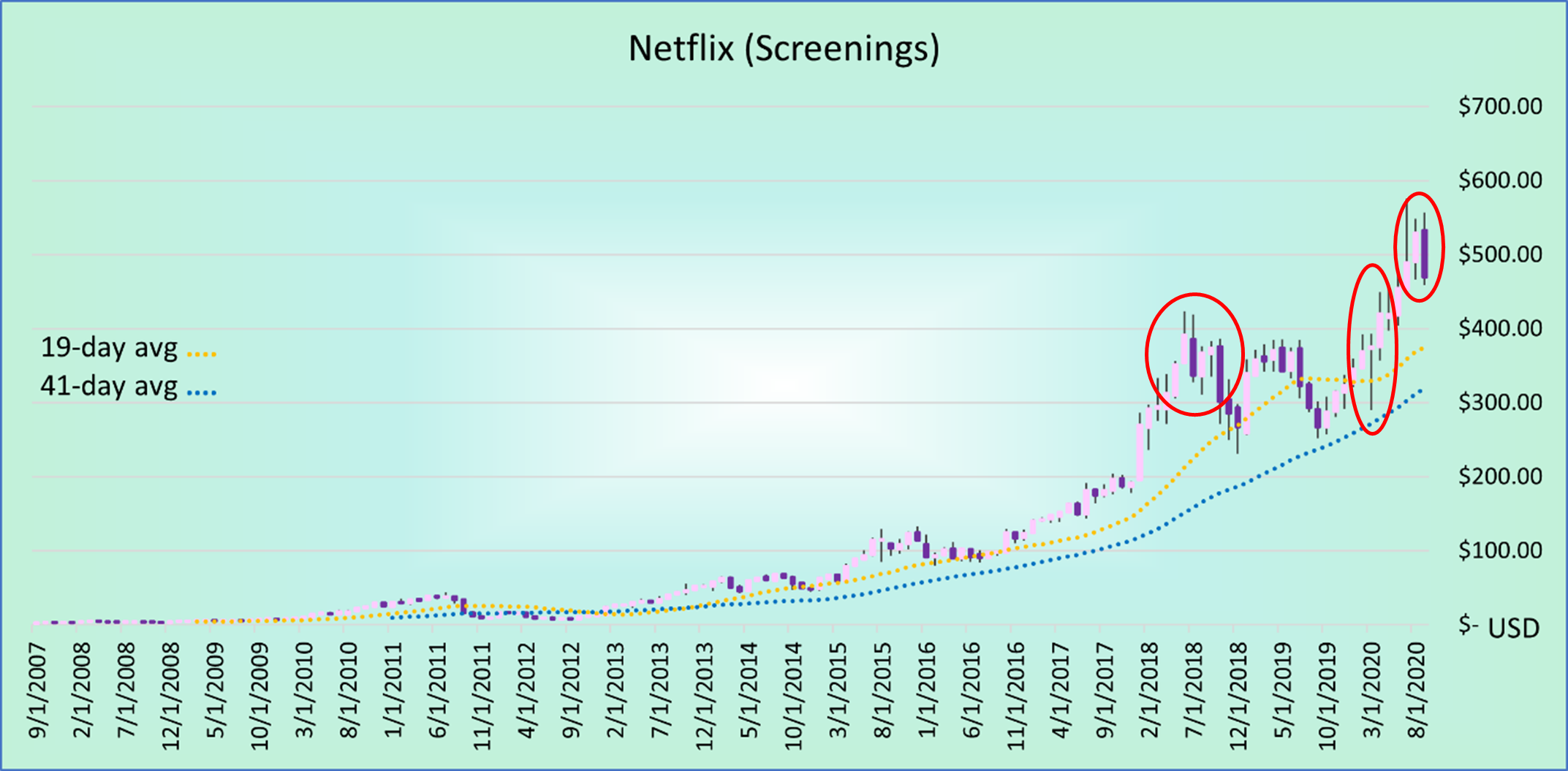

NYSE (ETFs) NYSE (ETFs)

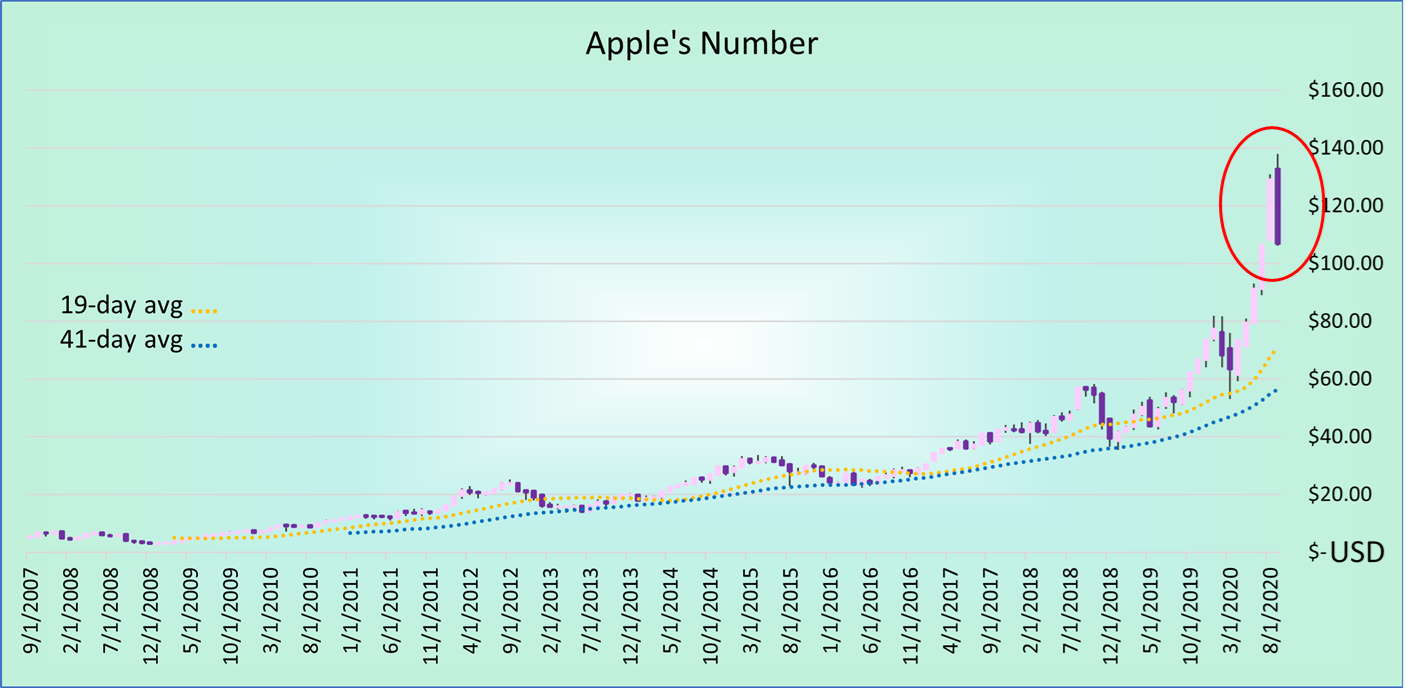

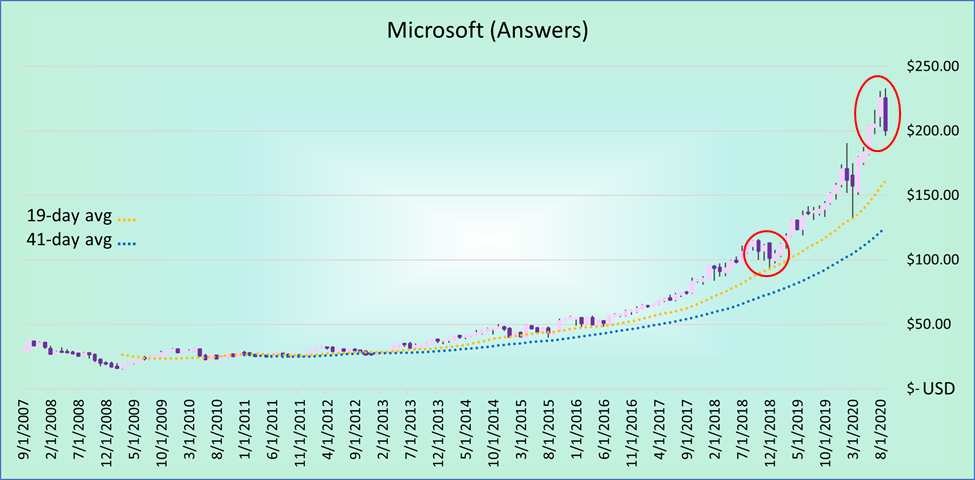

"The Too High Charts" "The Too High Charts"

|

Beyond the US Borders Beyond the US Borders

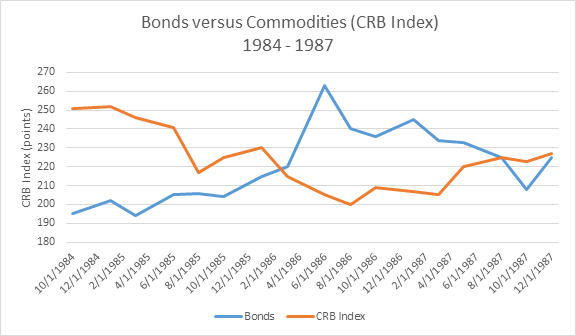

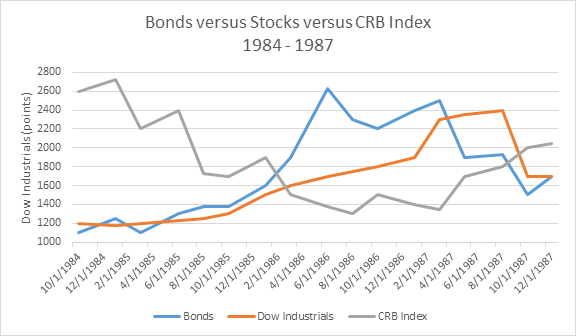

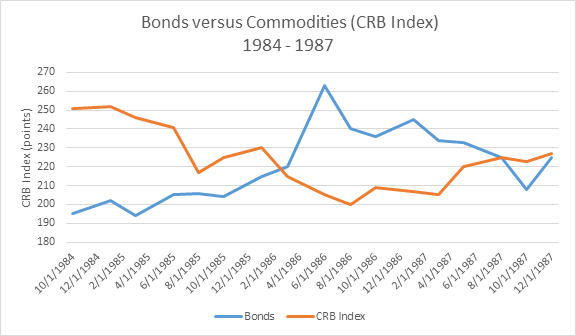

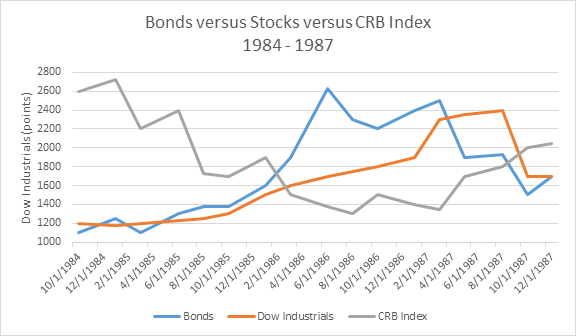

The inverse relationship (divergence) of the US Commodities Index (CRB Index) with US Treasury bonds from 1985 - 1987.

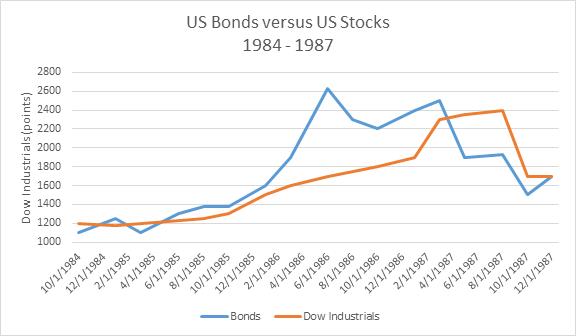

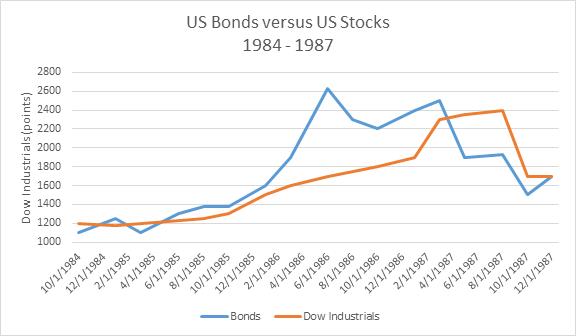

Since 1982 US bonds and stocks have rallied (converged) in sequence with each other. However, a panic alert shook US markets in 1986 over lame duck US Presidents outweighed from the space race.

The momentum of the US economy at the peak of the Cold War. The US bond market crash in April 1987 was a result of US President Ronald Reagan’s defeat in the arms race which remains scrutinized.

Global South Global South

Socio-economically, the Global South is resilient with nations such as: Mexico, India, Indonesia, South Africa and Egypt among several others which add intensity to global economic prosperity. Likewise, tensions from the Cold War years in the Global South reflect a demand in the US for social equality.

Africa South-America Pact (ASA Pact) Africa South-America Pact (ASA Pact)

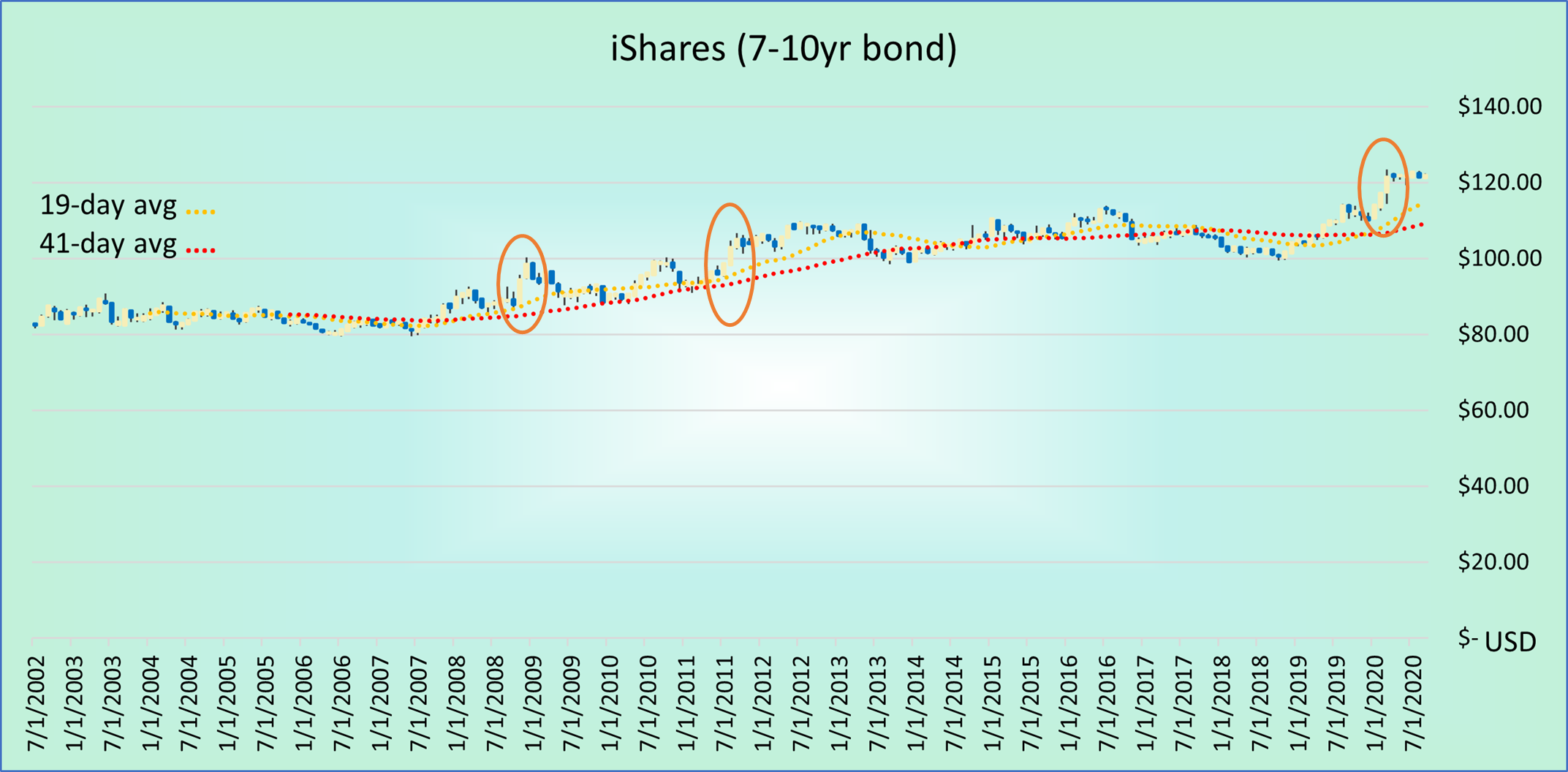

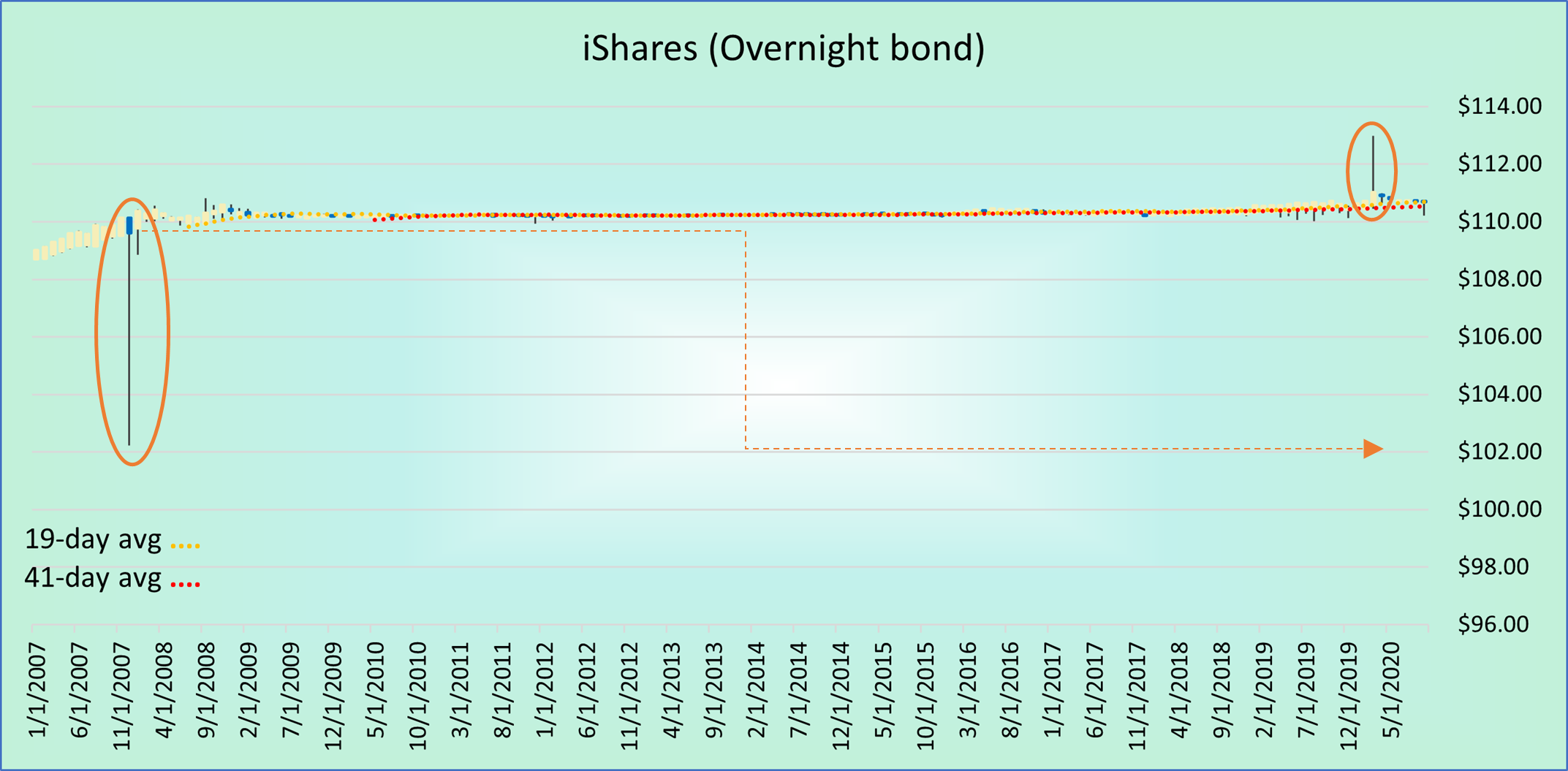

Historically, Africa and South America have formed a framework for international trade which uphold the highest expectations for future prosperity. Meanwhile, the ASA Pact solidifies the unity which is vital to ongoing economic expansion world-wide. Visciously, the COVID-19 pandemic weighs with mature US 10-yr treasury bonds.

|

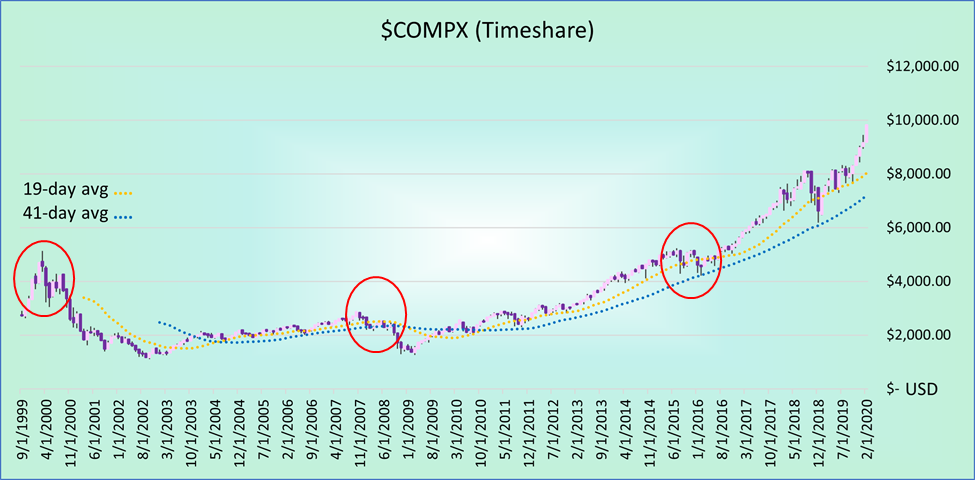

NASDAQ NASDAQ

"The Phone Line Down" "The Phone Line Down"

|

LATPACT Trade Commission

LATPACT Trade Commission

Greater Clearinghouse

Greater Clearinghouse

Far East Commerce Bank

Far East Commerce Bank

LATPACT Open Market

LATPACT Open Market

Central Monitoring Services

Central Monitoring Services

Greater SOCIETY

Greater SOCIETY

Commodities Review

Commodities Review

Currency Central

Currency Central  LATPACT Open Market

LATPACT Open Market  Equities Report

Equities Report

The Noise Maker

The Noise Maker

Historical Lessons

Historical Lessons