FOREX Analysis |

Economic issues with the IMF are the current focus of our Forex Trend Analysis. Meaning, we can easily identify global economic issues by following currency trends. Currency trends must be identified before making any investment decision.

The following currency pairs represent a significant issue for the IMF. Currently, the IMF is constricted from expanding further around the world because of dominating news from Europe over NATO's nuclear build-up and potential war against Russia. Let’s take a glimpse at how severe a sudden IMF panic can become by weighing the situations driving each of these currency pair’s performance in 2015.

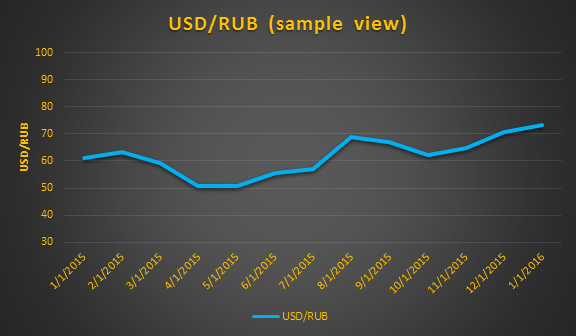

The USD has forced the RUB to rely on its political backbone for economic growth. The US continues to mount sanctions against Russia while building up nuclear weapons near every border. This has forced Russia to demonstrate its will to maintain nuclear parity across the globe.

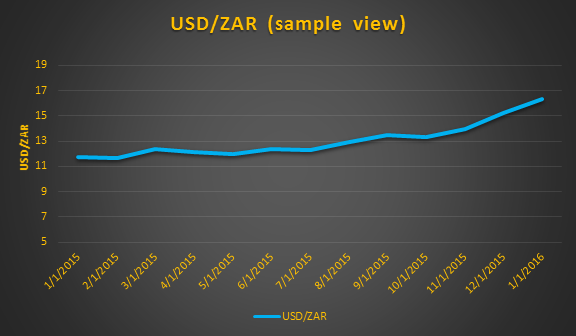

The USD continues to force the ZAR to rely on its mineral resource rich economy for economic growth.

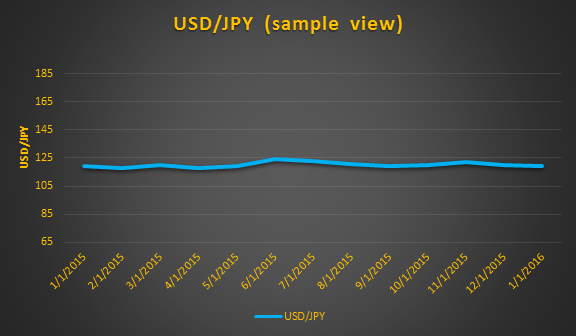

The USD has stripped the JPY of its international appeal because the TPP agreement lacks the economic strength for the US Military to peacefully pivot in Asia.

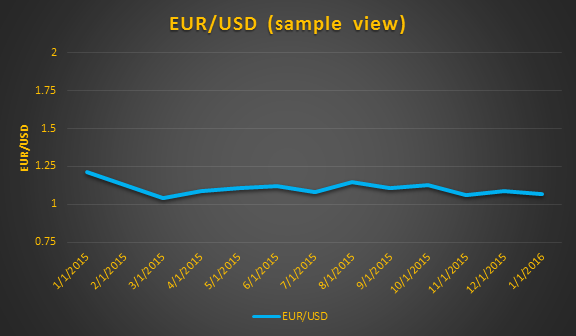

The Euro has generated major pressure in the IMF. It is now a major issue to continue lending reserve currencies which suffer from major political backlashes such as Brexit, Black Lives Matter and Global Warming.