News Feed

Limited Edition

The September Ticker

The September Ticker

"Prepare for Sea Launch"

MICEX Intermarket News

MICEX Intermarket News

|

|

|

|

|

The Brent Strike

|

|

|

|

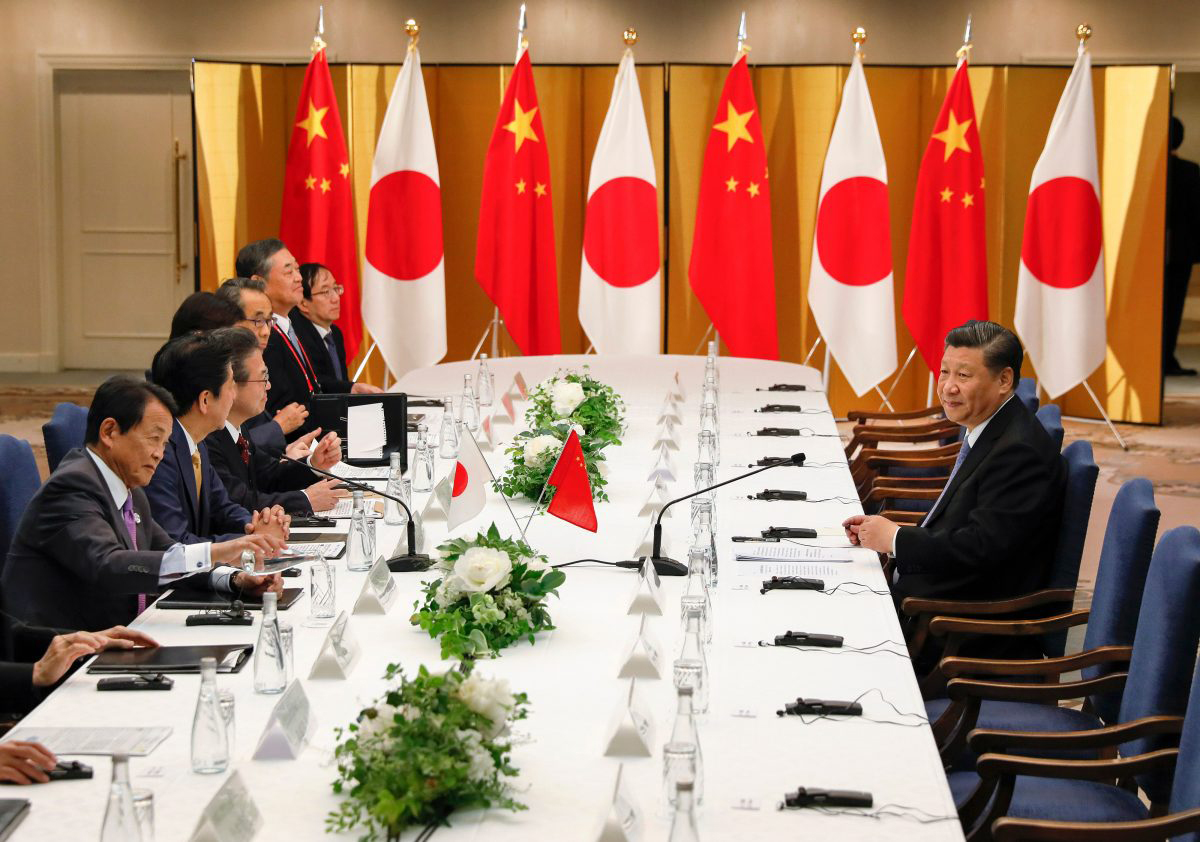

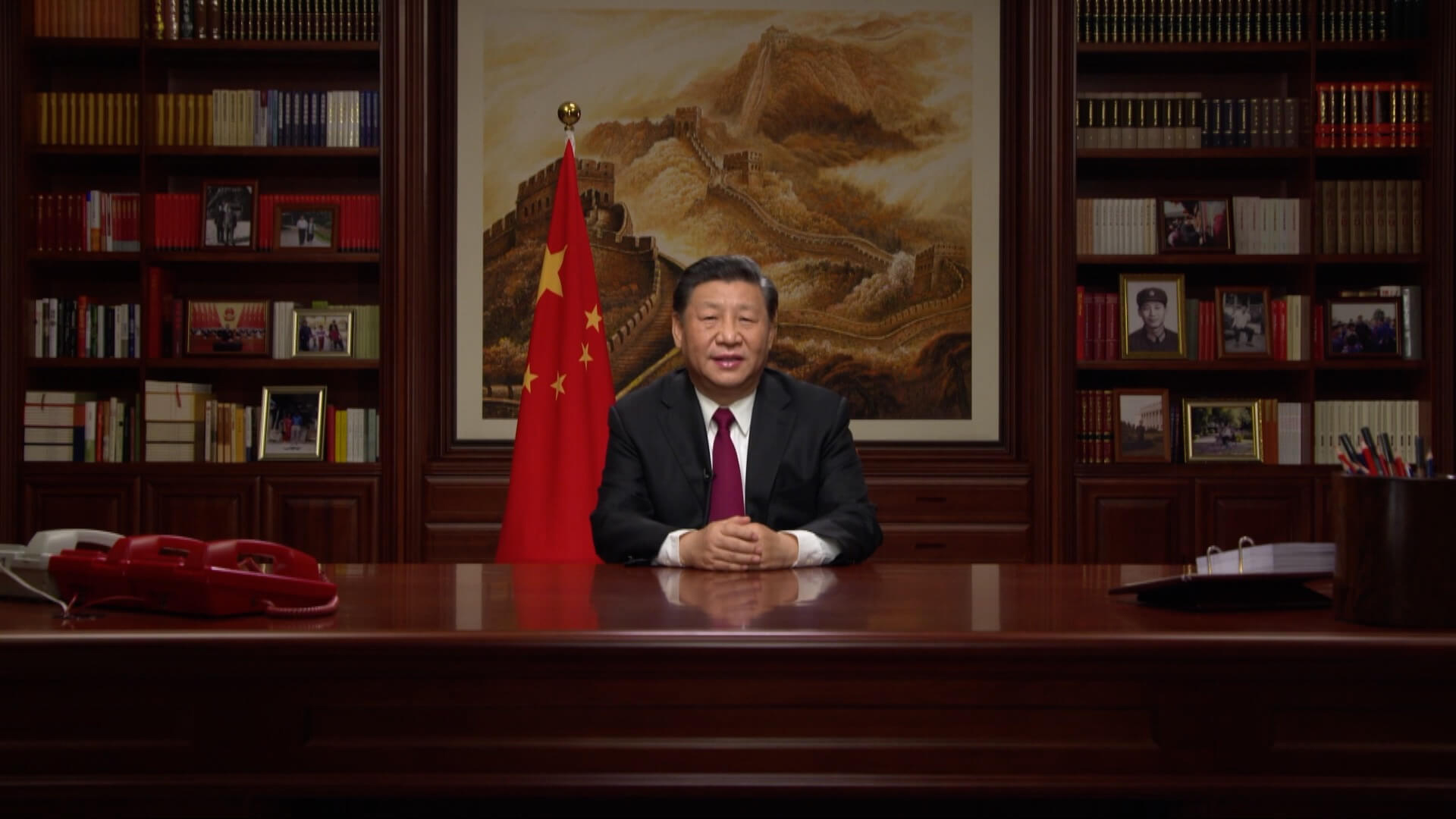

China Props Yuan as Hong Kong Ditches Dollar

China Props Yuan as Hong Kong Ditches Dollar

10.09.2020

21:04 PST

SF Bay Area, CA – Domestically, China is accelerating exchange for the yuan as trade tensions with the US diminish relations in Hong Kong over the military state of Taiwan. Robustly, China has rooted its monetary policy to outpace the dollar over the next decade while issues in Hong Kong over its pegged currency subside. Economically, appreciation of the yuan allows for Hong Kong traders to settle transactions on a national payment system that is used for making international payments. Accordingly, trade tensions between China and the US propels Hong Kong into flight for safety as US 10-year bonds face major geo-political turbulance.

Recently, Paul Mackel head of research for HSBC’s emerging markets foreign exchange mentioned, "Against these external and domestic drivers supporting the yuan, we believe Chinese policymakers would need to tolerate further yuan appreciation."

Likewise, Mackel stated, "There will likely be occasional two-way fluctuations caused by potential geopolitical headlines, but we doubt that will change the overall [appreciation] trend." Politically, Hong Kong is pacing the yuan to offset economic relapse lingering from the US trade war as foreign investors shift over geo-political mishaps. Aggressively, China has begun to reshape the balance in trade for both its imports and exports from appreciation of the yuan. Internationally, the US trade war is igniting an economic flight to safety as pressure in Hong Kong to ditch the dollar mounts. Moreover, Zheng Wei the deputy head of China's State Administration of Foreign Exchange indicated, "The yuan exchange rate remains flexible and resilient, playing the role of stabiliser well in adjusting the international balance of payments."

[Top]

[Top]