News Feed

Limited Edition

January Ticks

January Ticks

"Wintering the Arctic"

MICEX Intermarket News

MICEX Intermarket News

|

|

|

|

|

The Brent Strike

|

|

|

|

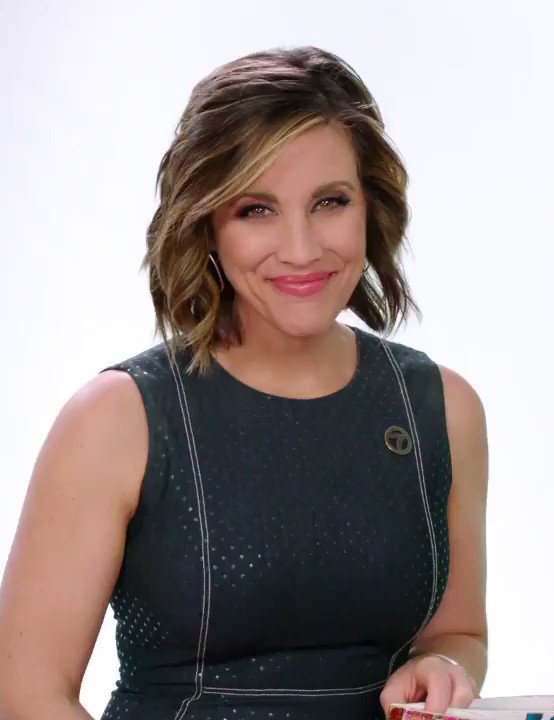

OPEC+ Begins New Year With Momentum

OPEC+ Begins New Year With Momentum

08.01.2021

14:51 PST

SF Bay Area, CA – Keenly, OPEC+ nations began the new year in favor of setting new parameters for the first quarter to meet various fiscal agendas. Steadily, oil prices have reached higher highs during the turn of the year which has led OPEC+ at the round table. Globally, uncertainty over economic sanctions and military tensions from Iran is supporting the slow return of higher crude prices. Likewise, the impact from major lockdowns over the height of the COVID-19 pandemic is fading away volatility in the oil market. Appropriately, Saudi Arabia agreed on reducing oil production for the first quarter which weighs against ongoing US military threats to Iran. Meanwhile, restoring oil production at OPEC+ is a major priority for the mid-term which reflects in Russia's production output.

Effectively, Russia’s Deputy Prime Minister Alexander Novak stated, "We see that the worst situation is already behind us - this was April - May last year. The demand is gradually recovering, despite all the uncertainties and new lockdowns."

Financially, crude oil prices topped $56 per barrel for the opening week of the new year. Productively, OPEC+ reached an agreement to reproach US policies which produce greater uncertainty on the market. Politically, long-term stability in crude prices remain a major priority as special trade agreements become incentives as oil prices rise in the future. Easily, members of OPEC+ achieved production goals set in November of reducing production as the COVID-19 pandemic slowed economic activity. Prudently, OPEC+ has set a fiscal agenda which includes regular meetings over production issues. Assuredly, the year ahead will add support against a decline in oil prices ignited from political rivalry.

MICEX Intermarket News

MICEX Intermarket News

|

|

|

|

|

The Gold Zone

|

|

|

|

India Enters Territory for Digital Transformation

India Enters Territory for Digital Transformation

12.01.2021

17:10 PST

SF Bay Area, CA – Globally, the currency market (FOREX) rests against several major indicators of economic growth as decline lingers from the COVID-19 pandemic and US trade war with China. Progressively, the US dollar is swinging around political turmoil as unemployment figures in the West take shape. Additionally, economic development for advanced economies have accelerated into a digital transformation which includes a new form of international payments on trade deals. Effectively, the economic risk associated with political instability from western stagnation enables India to explore new opportunities awaiting from digital transformation.

Significantly, US dollar swings on FOREX foreshadow volatile trade volume against US stocks and has disrupted international trade. Furthermore, US economic sanctions diminish the luster for western currencies.

Fiscally, India's monetary policies include a growing period of digital transformation as currency, gold and IMF reserves reach a political threshold. Prudently, India's central bank has shuffled its foreign currency assets to reflect the weight of political scandal from the West. Daily, shifts on overnight trading platforms enable transformation into the digital demand for international trade. Primarily, the Chinese yuan and euro reflect growing international trade in India as digital transformation develops. Intently, India has reduced the grip of the IMF as the rupee stabilizes against rampart military tensions in the region. Accordingly, higher inflation in India signals a currency leap from mid-term rates as digital transformation accelerate international trade.

MICEX Intermarket News

MICEX Intermarket News

|

|

|

|

|

|

|

|

|

Iran Thwarts US Maximum Pressure Policy

Iran Thwarts US Maximum Pressure Policy

12.01.2021

22:08 PST

SF Bay Area, CA – Evasively, the US has threatened Iran with maximum pressure to adhere to neighboring patronage of US military forces. Futilely, US attempts to bind al-Qaeda militia, political activist and foreign investors in the region with western democracy have unleashed a political storm against US policies in Iran. Globally, the US has relied on its maximum pressure policy, which include frozen assets in Far East Asia, to shake Iran's political pillars. Militarily, Iran has responded to US pressure at a momentous pace as preparation to roll out a new helicopter carrier is set underway. Particularly, a new missile destroyer for far open water drills in the Indian Ocean has been unveiled.

Economically, Iran has initiated actions to retrieve frozen funds in the Far East held by South Korea over US economic sanctions which fray political ties between the nations. Diplomatically, the US military pivot to Asia underscores diminishing ties from Iran over perilous sanctions.

Openly, Iran's Central Bank Governor Abdolnasser Hemmati mentioned, "I reminded the Koreans and emphasized that Iran’s blocked funds in (South) Korea belong to the Iranian nation and no one is allowed to play tricks on them." Readily, Iran's military is engaged with expanding its reach beyond limits imposed in the US. Attractively, regional stability accelerate from Iran's maritime ambitions which include development of a mobile seaport, rapid deployment of special forces and new multi-mix amphibious assault tactics. Importantly, Iran has served a notice for the apprehension of US President Donald Trump in the wake of the inauguration of newly elected candidate Joe Biden which intensifies momentum.

MICEX Intermarket News

MICEX Intermarket News

|

|

|

|

|

|

|

|

|

US Economic Stimulus Nullified From Trade War

US Economic Stimulus Nullified From Trade War

13.01.2021

00:22 PST

SF Bay Area, CA – Sluggishly, Silicon Valley venture capitalist await the impact from a US stimulus bill as shockwaves abound from the trade war with China. Swiftly, China has shifted economic expansion away from US partnerships and foreign investments which leave venture capitalists high and dry. Effectively, financial markets in Shanghai, Hong Kong and Tokyo weigh above expectations from government stimulus in the US. Yet, the markets in Seoul and Sydney mitigate the economic turbulance lingering from the US trade war with China.

DETAILS TO FOLLOW

[Top]

[Top]